Method of net basis of accounting - Google Adwords income whether taxable for Google Ireland in India by way of Assessee becoming a Dependent PE (DAPE)

Facts :

Assessee had revenue sharing distribution rights with Google Ireland for its AdWords program where in advertisements are hosted in Google website on revenue sharing basis with Google Ireland by Google India (assessee). The amount payable to Google Ireland was netted off and only the net income was shown as the assessee's revenue. Revenue rejected the books (due to net revenue disclosure instead of gross revenue) alleging assessee created a Dependent PE for the Irish entity in India and held that the amount payable to Google Ireland out of the proceeds received by them for AdWords was taxable in India as royalty under Indo-Ireland DTAA and since no TDS was done the same was also disallowed in the hands of the assessee. In TP proceedings ALP (Arm's length price) was accepted by the revenue. Aggrieved by the rejection of books by AO and CIT(A) and on the taxability due to DAPE, assessee went in appeal to ITAT -

Held in favour of the assessee that the amounts payable to Google Ireland for AdWords program does not trigger a DAPE and no TDS is required to be made on the same. Rejection of books was incorrect.

Grounds of assessee -

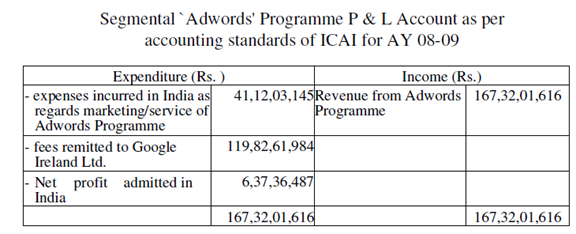

Recasting of P&L by revenue does not alter the profits subject to tax in India. Remunerating agent at ALP negates further profit attribution in India. Earlier year case of the assessee held that no TDS was required on AdWords program payments to Google Ireland.

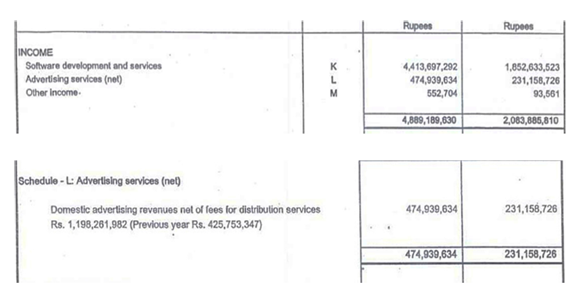

Assessee's disclosure on the P&L account

Recast P&L by revenue authorities

Case: Google India (P) Ltd. v. Addl. CIT 2023 TaxPub(DT) 2108 (Bang-Trib)